Opportunity Zones can transform economically distressed areas while benefiting investors with significant tax incentives. This article explores strategies to maximize the impact of Opportunity Zone investments for both economic revitalization and social improvements, particularly through the 1776ing platform.

Key Takeaways

- Opportunity Zones incentivize investments in economically distressed areas through substantial tax benefits, aiming to spur long-term economic growth and job creation in underserved communities.

- Investments in Opportunity Zones can yield significant financial rewards, such as deferred capital gains taxes and potential permanent exclusion of gains if held for ten years, making them attractive for investors.

- Effective leveraging of Opportunity Zones involves environmental due diligence, social impact projects, strong marketing, local government incentives, community partnerships, and regular metrics to evaluate economic, social, and environmental impacts.

Introduction

Opportunity Zones are more than just an economic development tool; they are a catalyst for change in economically distressed areas across the country. Created under the Tax Cuts and Jobs Act of 2017, these zones aim to incentivize new investments in underserved communities by offering substantial tax benefits to investors. With 8,764 designated Opportunity Zones across the United States, the program’s primary goal is to spur economic growth and job creation, providing a much-needed boost to low-income neighborhoods.

The purpose of Opportunity Zones is to:

- Redirect capital towards underserved areas

- Encourage long-term investments that can revitalize communities and create sustainable jobs

- Offer tax incentives to make it more attractive for investors to put their money into projects that benefit both the community and their own financial interests.

This article will delve into the various strategies and considerations for investing in Opportunity Zones for sustainable development, social good and strong returns, with a focus on the tools and resources available through 1776ing.

Understanding Opportunity Zones

To effectively leverage Opportunity Zones, it’s crucial to understand what they are and why they were created. Opportunity Zones are designated areas aimed at incentivizing investments in underserved communities to spur economic development and job creation. With a total of 8,764 Opportunity Zones across the United States, these areas are specifically intended to attract new investments through preferential tax treatment.

Definition and Purpose

Opportunity Zones are economically distressed communities where new investments, under certain conditions, may receive preferential tax treatment. These zones were created through the Tax Cuts and Jobs Act of 2017 to address economic recovery in low-income areas. The designation process involves state governors nominating census tracts based on economic need, which are then certified by the U.S. Secretary of the Treasury. The primary goal of these zones is to attract long-term investments that can stimulate economic growth and job creation in underserved areas.

The purpose of Opportunity Zones is multifaceted. They aim to redirect capital towards areas that have faced long-term disinvestment, thereby facilitating improved infrastructure and stimulating economic growth. By offering tax incentives, these zones encourage private investors to contribute to the development of economically-depressed areas, creating a ripple effect that benefits both the investors and the communities involved.

Tax Incentives and Benefits

Investors in Opportunity Zones can reap significant financial rewards through various tax incentives. One of the primary benefits is the temporary deferral of capital gains taxes on earnings that are reinvested into Qualified Opportunity Funds (QOFs). This deferral lasts until the earlier of the date the investment is sold or exchanged, or December 31, 2026. Additionally, if the investment is held for at least five years, there is a 10% exclusion of the deferred gain, which increases to 15% if held for seven years.

Another substantial benefit is the permanent exclusion of tax on new capital gains from QOF investments if the investment is held for at least ten years. This means that investors are not required to pay federal capital gains taxes on any realized gains from the investment after a ten-year holding period. For example, a company’s investment in an Opportunity Zone hotel achieved tax-exempt growth after adhering to these guidelines.

These tax incentives are designed to make Opportunity Zones an attractive investment vehicle, encouraging more investors to participate in the economic revitalization of distressed areas. By deferring and potentially excluding capital gains taxes, the incentives help mitigate financial risks, making it easier for investors to commit their resources to these high-impact projects.

The Role of Opportunity Zones in Sustainable Development

Opportunity Zones play a vital role in promoting sustainable development by attracting investments that address both environmental and social challenges. These zones incentivize investment and economic development in distressed communities, providing federal tax benefits to investors for qualified uses. By driving both private and public investment, Opportunity Zones aim to stimulate long-term economic growth and job creation in regions that have faced long-term disinvestment.

Let’s explore the environmental and social impact considerations, along with other data, in more detail.

Environmental Considerations

Environmental due diligence is a critical component of sustainable development in Opportunity Zones. Before acquiring property, it is essential to identify potential environmental liabilities through comprehensive assessments. This process often includes Phase I and Phase II Environmental Site Assessments, which involve a thorough review of permits, sampling data, and historical land use.

By conducting these assessments, investors can ensure that their projects are environmentally sound and compliant with regulations. This not only mitigates potential risks but also contributes to the long-term sustainability of the development. Ensuring that Opportunity Zone investments adhere to environmental best practices is crucial for fostering a positive impact on both the community and the environment.

Social Impact Projects

Opportunity Zone investments can significantly enhance social good by funding projects that address critical needs in underserved communities. For instance, investments can be directed towards affordable housing and community centers, which provide essential services and support to local populations. Affordable housing projects, in particular, benefit from Opportunity Zone investments by offering much-needed housing options to low-income residents, thereby improving their quality of life.

Chicago’s Neighborhood Opportunity Fund is a prime example of how Opportunity Zone investments can support social impact projects. This fund allocates 80% of all bonus contributions to projects in underserved commercial corridors, while the Local Impact Fund dedicates 10% of contributions to local improvements within one mile of contributing development sites, including transit facilities and open spaces. These initiatives demonstrate the potential for Opportunity Zone investments to drive meaningful social change and community development.

What Makes an Attractive Opportunity Zone Investment for Investors at 1776ing?

An attractive Opportunity Zone investment on 1776ing offers a combination of strong financial returns, substantial tax benefits, and positive community impact. Qualified investors should carefully evaluate several key factors to identify high-potential projects within Opportunity Zones available on the 1776ing platform.

Financial Viability

The primary consideration for any investment is its potential for financial returns. Investors should look for projects listed on 1776ing marketplaces with solid business plans, clear revenue models, and realistic financial projections. Key indicators of financial viability include:

- Market Demand: Assess the demand for the project’s products or services within the target area. This involves researching local market conditions, competition, and potential for growth.

- Revenue Streams: Identify multiple revenue streams to mitigate risks and enhance profitability. For example, a mixed-use development might generate income from residential leases, commercial rents, and retail sales.

- Capital Structure: Ensure the project has a balanced capital structure with a mix of equity and debt financing that optimizes returns while managing financial risk.

Tax Incentives and Benefits

One of the main attractions of Opportunity Zone investments on 1776ing marketplaces is the potential for substantial tax savings. Investors should seek projects that allow them to maximize these benefits:

- Capital Gains Deferral: Look for investments that enable deferral of capital gains taxes until the earlier of the date the investment is sold or December 31, 2026.

- Exclusion of Gains: Prioritize projects that can be held for at least ten years to benefit from the permanent exclusion of taxes on any new gains.

- Additional Tax Credits: Consider opportunities in locations offering supplementary state and local tax incentives, such as additional credits or grants, to enhance overall returns.

Community Impact

Opportunity Zone investments available on 1776ing marketplaces are designed to spur economic development and improve quality of life in distressed areas. Investors should evaluate the potential community impact of a project:

- Job Creation: Projects that generate significant employment opportunities for local residents are particularly valuable. This not only boosts the local economy but also garners community and government support.

- Affordable Housing: Investments in affordable housing can address critical needs in underserved communities, providing stability and improving living conditions for low-income families.

- Sustainable Development: Projects that incorporate environmentally sustainable practices, such as green building technologies or renewable energy, can reduce long-term operational costs and enhance community support.

Local Government and Community Support

Successful Opportunity Zone investments often benefit from strong local government and community backing. Investors using 1776ing should seek projects with:

- Local Incentives: Access to additional local incentives, such as tax abatements, grants, or infrastructure improvements, can significantly enhance the viability and profitability of a project.

- Community Partnerships: Engaging with community organizations and stakeholders ensures that the project aligns with local needs and priorities, increasing the likelihood of success.

- Regulatory Support: A favorable regulatory environment, facilitated by local government cooperation, can streamline project approval processes and reduce bureaucratic hurdles.

By focusing on these factors, investors can identify Opportunity Zone investments on 1776ing that offer not only attractive financial returns and tax benefits but also contribute to sustainable community development and economic revitalization.

Measuring Success and Outcomes

Measuring the success and outcomes of Opportunity Zone investments is crucial for determining their effectiveness in promoting sustainable development and social good. Assessing the economic, social, and environmental impacts of these investments helps in understanding their overall impact and areas for improvement.

Let’s explore the metrics used to evaluate economic benefits and social and environmental impacts.

Economic Development Metrics

Evaluating economic benefits such as increased employment and new business formation is essential for measuring the success of Opportunity Zone investments. These metrics provide a clear indication of the economic growth stimulated by these projects. Comparing Opportunity Zones to similar, non-designated low-income census tracts can help measure the relative impact of these investments.

By focusing on economic metrics, stakeholders can assess the effectiveness of Opportunity Zones in achieving their primary goal of spurring economic development and job creation. This data-driven approach ensures that investments are making a tangible difference in the targeted communities.

Social and Environmental Impact

Assessing the long-term social and environmental benefits of Opportunity Zone investments is essential for understanding their overall impact. Tools like the Equitable Investment Atlas allow users to search all designated Opportunity Zones in the U.S. and evaluate their economic, environmental, demographic, housing, and infrastructure characteristics. This comprehensive assessment helps in identifying the broader impact of these investments on communities.

Evaluations should also consider displacement effects and higher housing prices due to tax incentives, ensuring that the benefits of Opportunity Zone investments extend beyond the period of subsidies. By focusing on both social and environmental impacts, stakeholders can ensure that these investments contribute to sustainable development and social good.

Case Studies of Successful Opportunity Zone Projects via 1776ing

Real-world examples of successful Opportunity Zone projects available to qualified investors via 1776ing provide valuable insights into the potential of these investments. These case studies highlight the positive impact of Opportunity Zones on communities, showcasing how targeted investments can drive economic growth and community revitalization.

Urban Revitalization through 1776ing

One standout example of how Opportunity Zones can catalyze urban renewal is evident in the projects facilitated by 1776ing. By focusing on economically distressed neighborhoods, these projects have not only revitalized commercial spaces but also boosted local employment, creating a ripple effect of economic growth and community improvement.

Example: Urban Renewal Projects

1776ing has played a crucial role in facilitating investments in urban renewal projects. By leveraging Opportunity Zone incentives, the platform is helping to transform neglected neighborhoods into vibrant communities. These projects have attracted significant investments, leading to the revitalization of commercial spaces and the creation of new jobs. This demonstrates the transformative potential of Opportunity Zone initiatives managed through 1776ing.

Example: Affordable Housing Initiatives

Affordable housing is another critical area where 1776ing has made a substantial impact through Opportunity Zone investments. The platform features projects that provide much-needed housing for low-income communities in various cities. These initiatives often include mixed-income developments, which help diversify communities and offer housing options for a broader range of residents.

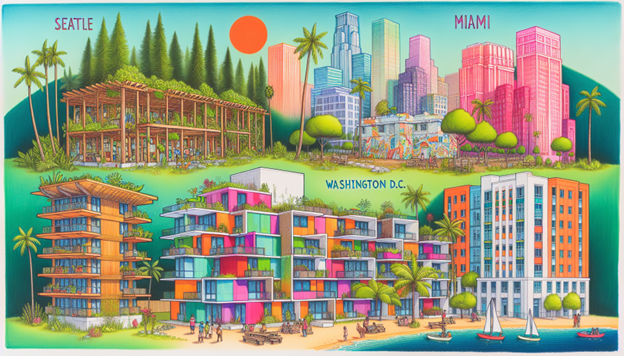

For instance, in cities like Seattle and Miami, Opportunity Zone investments facilitated by 1776ing have funded affordable housing projects that address critical housing shortages, improve the quality of life for residents, and contribute to long-term social stability and economic growth.

Leveraging Local Incentives and Community Partnerships

1776ing’s approach to Opportunity Zone investments emphasizes the importance of local government incentives and community partnerships. By collaborating with local governments and community organizations, 1776ing ensures that investments align with local needs and priorities, enhancing the attractiveness and feasibility of Opportunity Zone projects.

Example: Public-Private Partnerships

Public-private partnerships have been a cornerstone of 1776ing’s strategy. These collaborations enable projects to benefit from additional local incentives such as tax abatements, grants, and infrastructure improvements. These partnerships help streamline the approval process, provide additional support, and significantly improve the success rate and impact of Opportunity Zone projects.

By focusing on successful case studies and leveraging local partnerships, 1776ing demonstrates how Opportunity Zone investments can drive substantial economic growth and community revitalization. These projects not only provide financial returns to investors but also contribute to the broader goal of sustainable development and social good.

1776ing strategically facilitates Opportunity Zone investments, showcasing their transformative potential. By highlighting successful urban revitalization and affordable housing projects, 1776ing offers a clear roadmap for investors to achieve substantial returns while supporting community development. Leveraging local incentives and fostering public-private partnerships, 1776ing ensures impactful and sustainable investments. For more information, visit 1776ing.

Affordable Housing Initiatives

Opportunity Zone investments have also played a crucial role in funding affordable housing projects across various cities. In places like Seattle, Miami, and Washington, D.C., these investments have provided much-needed housing for low income communities. These projects often include mixed-income developments, which help to diversify communities and provide housing options for a broader range of residents.

By leveraging Opportunity Zones for affordable housing initiatives, cities can:

- Address critical housing shortages

- Improve the quality of life for low-income residents

- Provide immediate benefits to the community

- Contribute to long-term social stability and economic growth.

Technical Assistance and Resources at 1776ing

Navigating the complexities of Opportunity Zones can be challenging, but 1776ing offers a variety of resources to help investors and developers succeed. From federal programs to extensive support tools, these resources provide valuable guidance and ensure that Opportunity Zone projects are impactful and successful.

Federal Programs and Support

1776ing leverages support from various federal programs identified by the White House Opportunity and Revitalization Council. These programs enhance the feasibility of Opportunity Zone projects by offering targeted assistance:

- Economic Development Administration (EDA): Provides grants to support projects within Opportunity Zones, aiding in economic growth.

- Department of Housing and Urban Development (HUD): Offers funding through Community Development Block Grants (CDBG), which can be used to develop housing and improve infrastructure in Opportunity Zones.

- Small Business Administration (SBA): Has programs that assist businesses located in Opportunity Zones, encouraging economic development and job creation.

By utilizing these federal programs, investors and developers on the 1776ing platform can maximize the impact of their Opportunity Zone projects and ensure long-term success.

Technical Support and Resources

1776ing provides a range of resources designed to help investors make informed decisions and manage their investments effectively:

- Project Listings and Analysis: Detailed listings of available Opportunity Zone investments, including financial projections, community impact assessments, and environmental considerations, are available on the 1776ing platform.

- Investment Tools: Access to webinars, white papers, and expert analyses that offer deeper insights into Opportunity Zone investments.

- Interactive Features: While specific mapping tools were not mentioned, the platform offers comprehensive project evaluation tools that help investors identify and assess potential investments more easily.

Community and Networking

1776ing also emphasizes the importance of community and networking through various events and partnerships:

- Industry Events: 1776ing organizes and participates in numerous industry events, providing opportunities for networking and learning about the latest trends and opportunities in Opportunity Zone investments.

- Collaborations: The platform collaborates with local governments and community organizations to enhance the attractiveness of Opportunity Zone investments. This includes showcasing local incentives, navigating regulatory frameworks, and building community partnerships.

By combining federal support with advanced investment tools and a strong emphasis on community and networking, 1776ing ensures that investors have the resources they need to navigate Opportunity Zone investments effectively. This comprehensive support helps stakeholders maximize their financial returns while contributing to sustainable economic development and community revitalization

Summary on how to leverage opportunity zones

Opportunity Zones offer a unique and powerful means to drive economic development and social good in underserved communities. By understanding the tax incentives and benefits, attracting investors, building partnerships with key stakeholders, and measuring success, stakeholders can effectively leverage Opportunity Zones for sustainable development. The case studies from Chicago and affordable housing initiatives across the country demonstrate the transformative potential of these investments.

As we look to the future, it’s crucial for investors, community leaders, and policymakers to continue collaborating and innovating within the framework of Opportunity Zones. By doing so, we can ensure that these investments not only provide immediate economic benefits but also contribute to long-term social and environmental sustainability. Together, we can create a more equitable and prosperous future for all.

Frequently Asked Questions

Opportunity Zones are economically distressed areas where new investments may receive preferential tax treatment, created to spur economic growth and job creation in low-income communities. These zones were established under the Tax Cuts and Jobs Act of 2017 and are intended to drive private investment into regions that have historically faced economic challenges.

By offering a range of tax incentives, Opportunity Zones aim to attract capital that can be used to develop infrastructure, support local businesses, and create jobs, thereby revitalizing these communities. The ultimate goal is to foster long-term economic stability and improve the quality of life for residents within these areas.

Investors in Opportunity Zones can benefit from deferring capital gains taxes by reinvesting in Qualified Opportunity Funds (QOFs) and from excluding new capital gains if held for at least ten years.

Opportunity Zones contribute to sustainable development by attracting investments that drive economic growth, create jobs, and address environmental and social challenges in underserved areas.

Local governments play a crucial role in Opportunity Zone projects by offering incentives, streamlining approval processes, and providing support through favorable policies and capacity-building programs. Their involvement can significantly impact the success of these projects.

You can find valuable guidance and support from federal programs and mapping tools like OpportunityDb to ensure the success of Opportunity Zone projects. These resources are available to investors and developers.