For accredited investors—those with a net worth exceeding $1 million (excluding their primary residence) or annual income above $200,000 ($300,000 joint)—real estate is a powerful wealth-building tool, but selling a property often comes with a steep tax penalty that can derail reinvestment plans. A 1031 exchange, named after Section 1031 of the Internal Revenue Code, offers a solution: it allows you to defer capital gains taxes by selling an investment property and reinvesting the proceeds into a “like-kind” replacement, preserving your full capital for growth, diversification, or legacy planning. Whether you’re upgrading rental income, diversifying your portfolio, or building tax-free wealth for heirs, completing a 1031 exchange successfully hinges on precision, compliance, and strategic foresight. This step-by-step guide walks accredited investors through the process in exhaustive detail, from preparation to closing, with tools like the Great Point Capital Alternative Marketplace streamlining the journey. Mistakes can cost you thousands—or millions—in taxes, so this 3,000+ word roadmap ensures you master the mechanics, sidestep pitfalls, and maximize the benefits of this tax-deferred strategy. Let’s dive into the nuts and bolts of executing a flawless 1031 exchange.

Understanding the 1031 Exchange: The Basics

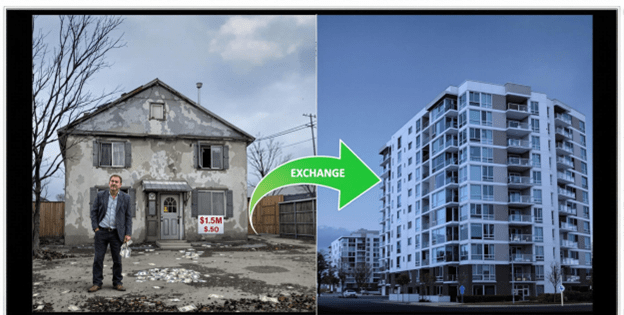

A 1031 exchange lets you sell an investment property—termed the “relinquished property”—and acquire a “like-kind” replacement property without paying immediate capital gains taxes, depreciation recapture, or, in some states, additional levies. “Like-kind” is a broad term: any U.S. real estate held for investment or business purposes qualifies, from single-family rentals to commercial buildings, raw land, or Delaware Statutory Trusts (DSTs). The catch? Strict IRS rules govern the process: you must use a Qualified Intermediary (QI), identify replacements within 45 days, and close within 180 days. For accredited investors managing multimillion-dollar portfolios, this isn’t just a tax trick—it’s a cornerstone for scaling wealth tax-deferred. IPX1031 calls it a way to “enhance investments,” and with proper execution, it can transform your real estate strategy.

Why a 1031 Exchange Matters for Accredited Investors

The stakes are high when you’re dealing with significant gains. Sell a $2M property bought for $500K, and you face a $1.5M gain—potentially $450K in taxes at a 30% combined federal and state rate (20% federal + 10% state, varying by location). A 1031 exchange keeps that $450K in your pocket, letting you reinvest the full $2M into a higher-value or better-performing asset. This tax deferral compounds over time: a $1M portfolio could grow to $5M or more through successive exchanges, all without tax erosion. For accredited investors, it’s a tool to optimize cash flow, diversify holdings, or plan a tax-free legacy, making mastery of the process non-negotiable.

Step-by-Step Guide to Completing a 1031 Exchange

Here’s a thorough breakdown of the process, designed to ensure success for accredited investors:

Evaluate Your Goals and Property

Start by assessing why you’re exchanging—higher rental income, diversification, or estate planning? Review your current property’s performance: a $1M rental with a $600K gain might yield 2% ($20K/year), signaling it’s time to upgrade. Check eligibility—only investment or business properties qualify, not personal residences. Consult a tax advisor to calculate gains and confirm the exchange aligns with your financial strategy. This step sets the foundation, ensuring your exchange delivers maximum value.

Select a Qualified Intermediary (QI)

A QI is mandatory— IRS rules forbid you from touching sale proceeds. Choose a reputable firm, with legal expertise and bonding, especially for multimillion-dollar deals—security is critical. Sign an exchange agreement before closing your sale, outlining the QI’s role in holding funds and facilitating the swap. For a $2M sale, the QI ensures your $1.5M gain stays tax-deferred, acting as your compliance gatekeeper. Research their track record; a slip here could unravel your exchange.

Market and Sell Your Relinquished Property

List your property with a real estate agent experienced in 1031 exchanges—timing is tight. For a $1.5M rental, aim for a swift sale to maximize your 180-day window, coordinating with your QI to escrow proceeds immediately. Disclose the exchange to buyers upfront to avoid delays—any hiccup could shrink your identification period. If it’s a hot market (e.g., February 20, 2025), leverage demand, but don’t let negotiations drag past your deadlines. Speed and precision here keep your tax deferral intact.

Identify Replacement Properties (45 Days)

Within 45 calendar days of closing, identify up to three replacement properties—or more under the 200% rule (total value ≤ twice the sold property’s price). For a $2M sale, you might target a $1.5M multifamily and a $1M DST stake, ensuring variety or higher yields. Use Great Point Capital’s Alternative Marketplace to source options—its platform connects you to listings, DST sponsors, and market data, simplifying this crunch-time task. Submit a written list to your QI, specifying addresses—vague picks risk IRS rejection. This step locks in your tax-deferred vision.

Evaluate and Negotiate Replacements

Due diligence is key—vet replacements for cash flow (e.g., 6% vs. 2%), appreciation, or legacy potential. For a $3M exchange, inspect a $2M commercial building’s leases or a DST’s sponsor track record via Inland Private Capital. Negotiate terms swiftly, as you’re racing the 180-day clock—delays could force a taxable fallback. Line up financing if needed; replacing a $1M mortgage requires matching or exceeding debt to defer all gains. Precision here ensures your new assets align with your goals.

Close on Replacement Properties (180 Days)

Finalize purchases within 180 days, using QI-held funds—total value must equal or exceed the relinquished property’s price (e.g., $2M sale needs $2M+ in replacements). For a $1.5M sale, close a $1M multifamily and $600K DST stake, coordinating with lenders, title companies, and your QI. Double-check compliance—no direct cash to you, or “boot” becomes taxable. Sign closing documents as an exchange, not a sale, to seal the tax deferral. This step completes your wealth-preserving swap.

File IRS Form 8824

Report the exchange on IRS Form 8824 with your tax return, detailing properties, dates, and gains deferred—e.g., $1M sale with $700K gain into $1.5M replacements. Your tax advisor ensures accuracy; errors could trigger audits or taxes. Keep records—deeds, QI agreements—for years, as the IRS may scrutinize past exchanges. This final step locks in your deferral, protecting your estate or reinvestment plans.

Real-World Examples: Success in Action

For accredited investors, the theoretical benefits of a 1031 exchange—tax deferral, portfolio growth, and strategic flexibility—come alive in real-world applications that showcase the process’s transformative power when executed with precision. These examples illustrate how savvy investors leverage the step-by-step guide to turn underperforming or appreciated properties into wealth-enhancing assets, all while keeping capital gains taxes at bay. From boosting rental income to consolidating portfolios and planning legacies, these scenarios demonstrate the tangible outcomes of a flawless 1031 exchange, proving it’s not just a tax strategy but a game-changer for real estate wealth management.

Example 1: Cash Flow Upgrade:

A $1M rental (gain: $600K) sells, and you exchange into a $1.5M multifamily yielding 6% ($90K/year) vs. 2% ($20K/year), deferring $180K in taxes, with your QI and Great Point Capital streamlining the 45-day identification and 180-day closing to ensure a seamless transition. This move triples your annual cash flow, turning a sluggish income stream into a robust revenue engine without losing a dime to the IRS. For an accredited investor, this upgrade showcases how a well-timed exchange can pivot a portfolio toward profitability in just a few months.

Example 2: Diversification Play

Four $500K rentals ($2M total, $1.2M gain) become a $2M commercial property, deferring $360K in taxes, with one asset to manage—completed flawlessly within deadlines, consolidating scattered holdings into a single, efficient investment. This shift slashes management overhead, replacing the chaos of multiple tenants with a stable, leased commercial space in a thriving market. It’s a textbook case of how a 1031 exchange can simplify your real estate empire while preserving every dollar of your gains for reinvestment.

Example 3: Legacy DST

A $1.8M property (gain: $1M) swaps into a $36M DST stake, deferring $300K in taxes, yielding passive income until heirs inherit tax-free—executed with precision to secure a hands-off legacy asset. By partnering with a QI and using tools like Great Point Capital’s Alternative Marketplace, you lock in a 5% annual return without the burden of active management, ensuring steady cash flow now and a clean inheritance later. This example highlights how a 1031 exchange can bridge current income needs with long-term estate planning goals, all tax-deferred.

Advanced Strategies for a Flawless Exchange

While the standard 1031 exchange process offers accredited investors a reliable path to defer taxes and reinvest capital, advanced strategies can elevate your execution to new heights, unlocking unique opportunities tailored to your goals. These techniques—reverse exchanges, improvement exchanges, and portfolio consolidation—require meticulous planning and coordination, but they reward savvy investors with greater flexibility, value creation, and efficiency in their real estate portfolios. Whether you’re racing to secure a dream property, enhancing an asset’s potential, or streamlining a scattered empire, these approaches ensure your exchange aligns perfectly with your long-term vision, all while keeping gains tax-deferred.

Reverse Exchange:

Buy the replacement first, then sell within 180 days—e.g., secure a $2M property, then offload a $1.5M rental—tricky but doable with QI support, allowing you to lock in a coveted asset before it’s gone. This flips the usual sequence, ideal when you spot a rare opportunity—like a high-yield multifamily in a booming market—that won’t wait for your sale to close. Your QI holds the new property in a special entity until the old one sells, ensuring compliance despite the complexity of this high-stakes maneuver.

Improvement Exchange:

Sell a $1M property and build on a $1.5M replacement (e.g., adding units), deferring gains if completed within 180 days—boosts value by customizing the asset to your exact specifications. Picture transforming a $1.5M fixer-upper into a $2M rental powerhouse with new apartments, all tax-deferred, increasing cash flow or legacy potential. The catch is timing—construction must finish within the 180-day window, so lean on a seasoned QI and contractors to hit the deadline and maximize your investment’s upside.

Portfolio Consolidation:

Swap five $400K rentals into a $2M multifamily, simplifying management while deferring $1M in gains—streamlines your estate into a single, high-performing asset for easier oversight or inheritance. This move cuts the chaos of juggling multiple properties—think tenant issues across five locations—into one efficient operation with economies of scale, like higher per-unit rents. It’s a strategic play for accredited investors aiming to reduce workload now and hand heirs a cohesive, tax-deferred portfolio later.

Common Pitfalls and How to Avoid Them

Even with a clear roadmap, a 1031 exchange can stumble into costly pitfalls that jeopardize tax deferral and undermine your investment goals, a risk accredited investors can’t afford when millions are at stake. These common errors—stemming from timing, cash handling, or property selection—can turn a tax-free triumph into a taxable headache, shrinking your capital and derailing your strategy. Understanding and dodging these traps is as critical as following the steps, ensuring your exchange delivers the wealth preservation and growth you expect.

Missing Deadlines:

A 46th-day identification or 181st-day closing voids deferral—use Great Point Capital tracking tools to stay on schedule and keep your tax savings intact. For a $2M sale with a $1.5M gain, missing the 45-day window could cost $450K in taxes, a devastating blow easily avoided with proactive planning. Set reminders and lean on technology to meet these unforgiving IRS deadlines every time.

Direct Cash Access:

Touching proceeds (boot) triggers taxes—ensure your QI holds every penny, even small leftovers, to maintain full deferral and protect your reinvestment power. Grabbing just $50K from a $1.5M sale could spark a $15K tax bill, chipping away at funds meant for a higher-yield replacement. Work closely with your QI to funnel all cash through escrow, leaving no room for accidental taxable missteps.

Non-Qualifying Property:

Exchanging into a personal residence fails—stick to investment assets, vetted with your advisor, to keep the IRS at bay and your exchange valid. Attempting to swap a $1M rental for a vacation home you’ll live in voids the deferral, potentially taxing a $600K gain and costing $180K—consult experts to confirm every property’s eligibility. This pitfall underscores the need for strict adherence to the “like-kind” investment rule.

Why Timing Matters in 2025

In 2025, real estate markets are shifting—rising values and potential tax law changes make now an ideal moment for accredited investors to execute a 1031 exchange. Property prices in key markets like Phoenix and Dallas are climbing, offering a chance to sell high and defer gains into appreciating or high-yield replacements before a potential plateau. Meanwhile, whispers of tax policy reform—possibly tightening 1031 rules or hiking capital gains rates—add urgency; locking in your tax-deferred gains now could sidestep future IRS hurdles. Platforms like Great Point Capital’s Alternative marketplace streamline this process, providing real-time market data and property options to capitalize on this dynamic landscape before the window narrows.

Beyond market trends and legislative risks, 2025 presents a strategic sweet spot for aligning your exchange with broader economic shifts, ensuring your portfolio thrives in an evolving environment. Interest rates, hovering near multi-year highs as of early 2025, signal a cooling phase that could depress yields on low-performing rentals—pushing investors to upgrade now while financing remains viable. Acting swiftly preserves your capital’s purchasing power, letting you secure assets with stronger cash flow or legacy potential, like DSTs or multifamily properties, ahead of increased competition or tighter lending. With Great Point Capital’s tools to track deadlines and source deals, you can seize this moment to execute a flawless exchange, future-proofing your wealth tax-deferred.

A Typical Investor Scenario: A $3M Exchange Masterpiece

John, an accredited investor, turned a single property into a tax-deferred success story in 2025, showcasing the power of a well-executed 1031 exchange. He owned a $1.5M rental in California, bought for $500K, now yielding just $30K/year (2%) with a $1M gain—facing $300K in taxes if sold outright. Opting for a 1031 exchange, John aimed to upgrade his cash flow and preserve his capital, leveraging his QI and Great Point Capital’s Alternative Marketplace for precision.

He sold the rental in March 2025, then identified a $2M Phoenix multifamily (6%, $120K/year) and a $1M DST stake in a $36M Dallas office tower (5%, $50K/year) within 45 days. Using Great Point’s Alternative marketplace, he sourced these high-yield options efficiently, closing both by August—120 days—well within the 180-day limit. His QI ensured all $1.5M flowed into the purchases, deferring the $300K tax bill.

The result? A $3M portfolio yielding $170K/year—over five times his prior $30K—all tax-deferred. This diversification across markets and asset types (active multifamily, passive DST) exemplifies a flawless exchange, boosting income and value without IRS interference. John’s success proves that with a QI, tools like Great Point Capital’s Alternative Marketplace and strict adherence to deadlines, a 1031 exchange can be a game-changer for accredited investors.

Conclusion

Completing a 1031 exchange successfully demands meticulous planning, but for accredited investors, the payoff—preserving capital, boosting returns, or securing a legacy—is worth it. With this step-by-step guide and tools like Great Point Capital’s Alternative marketplace, you’re equipped to execute a flawless exchange. Start today to unlock your real estate’s full potential, tax-deferred.

FAQs on Successfully Completing a 1031 Exchange

The 45-day identification window is tight—finding suitable replacements fast is tough, but Great Point Capital simplifies it. Missing it voids your deferral, so preparation is key.

Yes—replace debt (e.g., a $1M loan) with equal or greater debt to defer all gains, scaling your portfolio. It’s common and boosts buying power without cash outlay.

You’ll owe taxes on the gain—e.g., $300K on a $1M gain—but early planning with a QI avoids this. Have backups ready to beat the clock.

DSTs streamline closings with pre-vetted options, often faster than traditional properties—ideal for tight deadlines. Inland Private Capital’s offerings fit seamlessly, reducing stress.

Ensure all proceeds go through your QI and replacements match or exceed the sold value—any cash taken is taxable. Precision with your QI prevents this pitfall.

Disclosures:

The content published on the 1776ing Blog is for informational and educational purposes only and should not be considered financial, legal, tax, or investment advice. The insights shared are intended to promote discussions within the alternative investment community and do not constitute an offer, solicitation, or recommendation to buy or sell any securities or investment products.