For accredited investors, building and preserving wealth through real estate is a proven strategy—but it’s not without challenges. One of the biggest hurdles? Capital gains taxes that erode profits when selling an investment property. Enter the 1031 exchange: a powerful tool under Section 1031 of the Internal Revenue Code that allows you to defer those taxes and reinvest your full proceeds into new properties. This ultimate guide explores how a 1031 exchange maximizes your investment potential, offering tax deferral, compounded growth, and access to sophisticated platforms like the Great Point Capital Alternative marketplace to streamline the process.

What is a 1031 Exchange?

A 1031 exchange enables investors to sell an investment property (the “relinquished property”) and reinvest the proceeds into a “like-kind” replacement property without paying immediate capital gains taxes. “Like-kind” is a broad term—any U.S. real estate held for investment or business purposes qualifies, from apartment buildings to commercial spaces or even raw land. By deferring taxes, you keep more capital working for you, amplifying your ability to scale your portfolio.

For accredited investors—those with a net worth over $1 million (excluding their primary residence) or annual income exceeding $200,000 ($300,000 joint)—this strategy is a game-changer. Pair it with tools like Great Point’s Alternative marketplace, and you’ve got a seamless way to navigate these complex transactions.

Why Tax Deferral is a Wealth-Building Superpower

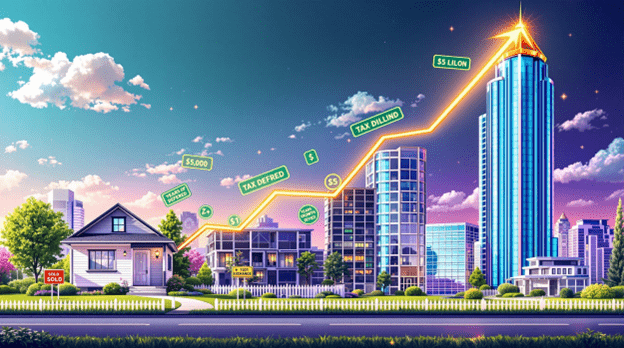

Tax deferral isn’t just about delaying a bill—it’s about leveraging your full equity to generate exponential returns. Here’s how a 1031 exchange transforms your investment potential:

- Preserve Your Capital: Selling a property with a $500,000 gain could trigger a tax bill of $100,000–$150,000 (depending on federal and state rates). In high-tax states like California, add another 13.3%. A 1031 exchange lets you reinvest that entire $500,000, not just what’s left after taxes.

- Compound Your Growth: Reinvesting the full amount into a higher-value or better-performing property sets off a compounding effect. Over multiple exchanges, a $1 million portfolio could grow to $5 million or more, all tax-deferred.

- Adapt to Opportunities: Markets shift, and so should your investments. Deferring taxes gives you the flexibility to upgrade, diversify, or reposition your holdings without losing capital to the IRS.

Real-World Example: The Power of Deferral

Imagine you sell a rental property purchased for $1 million, now worth $2 million. That $1 million gain, taxed at a combined federal and state rate of 30%, would cost you $300,000. Instead, with a 1031 exchange, you reinvest the full $2 million into a multifamily property yielding 5% annually ($100,000) versus the old property’s 2% ($40,000). Over 10 years, that extra cash flow, reinvested, could add hundreds of thousands to your wealth—all because you deferred taxes.

Beyond Deferral: Additional Benefits of a 1031 Exchange

While tax deferral steals the spotlight in a 1031 exchange, it’s merely the opening act in a broader performance of wealth-building benefits. For accredited investors, this strategy transcends postponing a tax bill—it’s a multifaceted tool that enhances cash flow, fortifies portfolio resilience, and secures generational wealth. By leveraging the full scope of a 1031 exchange, you’re not just preserving capital; you’re unlocking a suite of advantages that amplify your investment potential over the long haul. Platforms like the Great Point Capital Alternative Marketplace further empower you to harness these benefits, offering streamlined access to opportunities that align with your financial vision. Let’s dive into the standout perks that go beyond the tax deferral headline.

Depreciation Reset

Acquire a new property and reset its depreciation schedule, unlocking fresh tax deductions to offset income. Imagine swapping a fully depreciated rental property—where deductions have run dry—into a $2 million multifamily asset. With a 27.5-year residential depreciation schedule, you could claim over $72,000 annually in deductions, slashing your taxable income and boosting after-tax returns. For high-income investors, this reset is a strategic shield against tax burdens, compounding the value of your deferral.

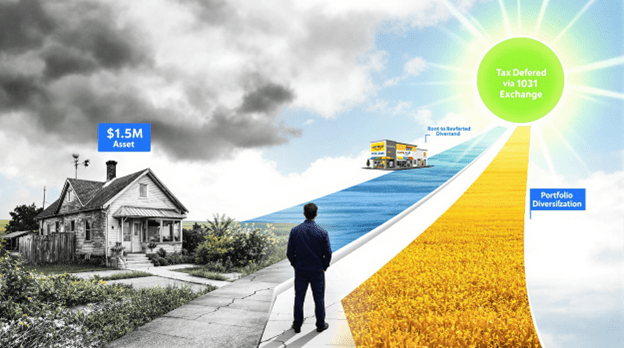

Portfolio Flexibility

Swap a single asset for multiple properties or shift from residential to commercial, diversifying your risk across markets and asset classes. For instance, sell a $1.5 million single-family rental and reinvest into a retail strip mall and a small apartment building, spreading exposure across different income streams and geographies. This adaptability lets you pivot from underperforming holdings or saturated markets into emerging opportunities, all tax-deferred—perfect for accredited investors seeking to optimize their real estate empire with agility and precision.

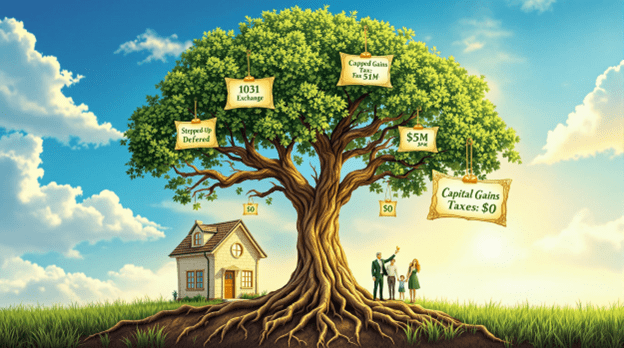

Perks for Real Estate Investors

Hold properties until death, and your heirs inherit them at a stepped-up basis, potentially erasing the deferred tax liability entirely. Picture deferring $2 million in gains across decades of exchanges; upon your passing, that tax debt vanishes as your heirs inherit at the current market value—say, $5 million—tax-free. This transforms a 1031 exchange into a legacy-building machine, allowing you to pass substantial wealth to the next generation without the IRS taking a cut. It’s a rare tax loophole that aligns perfectly with long-term family wealth goals.

Enter DSTs: Tax Deferral Meets Passive Income

For accredited investors seeking hands-off options, Delaware Statutory Trusts (DSTs) supercharge the 1031 exchange. A DST lets you own fractional interests in institutional-grade assets—think $50 million apartment complexes or Class-A office buildings—while keeping your tax deferral intact. These properties, managed by experienced sponsors, offer steady income and appreciation potential without the burden of day-to-day oversight. It’s deferral plus diversification, tailored for high-net-worth individuals.

How The Great Point Capital Alternative Marketplace Simplifies the Process

Executing a 1031 exchange involves strict IRS rules—45 days to identify replacement properties, 180 days to close, and a Qualified Intermediary (QI) to hold funds. For accredited investors managing substantial portfolios, precision is critical. That’s where Great Point Capital shines. Our platform offers a suite of tools designed to reduce friction in the investment process, connecting all parties—investors, QIs, and property sponsors—in one streamlined ecosystem. Whether you’re sourcing replacement properties, tracking deadlines, or exploring DSTs, Great Point Capital makes complex transactions efficient and transparent, empowering you to maximize your tax-deferred potential.

Steps to Maximize Your 1031 Exchange

- Plan Strategically: Assess your current property’s performance and define your reinvestment goals—higher cash flow, diversification, or legacy planning.

- Choose a QI: Select a reputable Qualified Intermediary (like Great Point Capital) to ensure compliance and safeguard your funds.

- Identify Properties: Use platforms like 1776ing to find “like-kind” options, from traditional properties to DSTs, within the 45-day window.

- Close the Deal: Leverage expert support to finalize your acquisition within 180 days, locking in your tax deferral.

Why Now is the Time

In 2025, with real estate markets fluctuating and tax policies under scrutiny, a 1031 exchange offers a rare certainty: the ability to defer taxes and reinvest aggressively. Whether you’re scaling your holdings, transitioning to passive income, or building a tax-efficient legacy, this strategy aligns with the goals of accredited investors. And with Great Point Capital’s Alternative marketplace reducing the complexity, there’s no better time to act.

Conclusion: Unleash Your Investment Potential

A 1031 exchange isn’t just a tax deferral tactic—it’s a wealth-amplification engine. By keeping your capital intact, you can compound returns, seize new opportunities, and optimize your portfolio like never before. For accredited investors, pairing this strategy with cutting-edge tools like the Great Point Capital’s Alternative Marketplace ensures you’re not just deferring taxes—you’re maximizing your financial future. Ready to take control? Start exploring your next exchange today.

FAQs: Unlocking Tax Deferral with a 1031 Exchange

A “like-kind” property is any U.S. real estate held for investment or business purposes—pretty broad, right? You can swap a rental house for an apartment building, a commercial office for farmland, or even a warehouse for a retail center. The key is intent: both the relinquished and replacement properties must be for investment, not personal use. Vacation homes or primary residences don’t qualify, but platforms like the Great Point Capital Alternative marketplace can help you explore a wide range of eligible options to maximize your tax deferral.

The savings depend on your gain and tax rate, but they’re significant. Sell a property with a $1 million gain, and you might face $200,000–$300,000 in federal and state capital gains taxes (20% federal + state rates like California’s 13.3%). A 1031 exchange defers that entirely, letting you reinvest the full $1 million. Over time, that preserved capital can compound into millions more, especially if you upgrade to higher-yield assets—think 5% returns versus 2%.

Absolutely! Delaware Statutory Trusts (DSTs) are a 1031-eligible option for accredited investors, letting you own fractional shares in institutional-grade properties—like a $50 million multifamily complex—without managing tenants or repairs. You defer taxes and gain passive income, often 4–6% annually, with professional management. Great Point Capital’s Alternative Marketplace excels here, and connects you to DST opportunities, simplifying the shift from active to passive wealth-building.

The IRS is strict: you must identify replacement properties within 45 days of selling and close within 180 days. Miss either, and your exchange fails—taxes kick in immediately. That’s why planning is critical. A Qualified Intermediary (QI) keeps you compliant, and tools from Great Point Capital help track deadlines and source properties fast, ensuring you don’t lose your deferral over a timing slip-up.

Yes, especially for estate planning. Defer taxes now, and if you hold until death, your heirs inherit at a stepped-up basis—potentially erasing all deferred gains. A $2 million gain could become $5 million over decades; your heirs get it tax-free. Plus, you can upgrade properties along the way for better cash flow or diversification. It’s not just deferral—it’s a strategy to maximize your investment potential for generations.

Disclosures:

The content published on the 1776ing Blog is for informational and educational purposes only and should not be considered financial, legal, tax, or investment advice. The insights shared are intended to promote discussions within the alternative investment community and do not constitute an offer, solicitation, or recommendation to buy or sell any securities or investment products.