Real estate is a cornerstone of wealth for accredited investors—those with a net worth exceeding $1 million (excluding their primary residence) or annual income above $200,000 ($300,000 joint)—but concentration in a single property or market can spell trouble. A single-family rental in a volatile city, a commercial space tied to one industry, or a portfolio overly reliant on active management can expose you to unnecessary risks. What if you could sell that property, reinvest the proceeds into a diverse mix of assets, and defer the capital gains taxes that typically erode your capital? That’s the power of a 1031 exchange, a tax-deferred strategy under Section 1031 of the Internal Revenue Code. This guide explores how accredited investors can leverage a 1031 exchange to diversify their real estate portfolios, spreading risk, boosting resilience, and aligning investments with long-term goals—all with tools like Great Point Capital’s Alternative marketplace to streamline the journey.

Understanding the 1031 Exchange: A Tool for Diversification

A 1031 exchange allows you to sell an investment property—known as the “relinquished property”—and reinvest the proceeds into one or more “like-kind” replacement properties without paying immediate capital gains taxes. The term “like-kind” is deceptively flexible: it encompasses any U.S. real estate held for investment or business purposes, from single-family rentals to sprawling commercial complexes, undeveloped land, or even fractional interests in Delaware Statutory Trusts (DSTs). The catch? You must follow strict IRS rules, including using a Qualified Intermediary (QI) and adhering to tight timelines—45 days to identify replacements and 180 days to close.

For accredited investors, this isn’t just a tax deferral tactic—it’s a strategic pivot point. By preserving your full sale proceeds, you can reallocate capital into a variety of assets, reducing dependence on a single property type, geographic region, or income stream. IPX1031 emphasizes this as a way to “diversify the real estate portfolio, thereby hedging the investment risk inherent in a single property.” Whether you’re seeking stability, growth, or passive income, a 1031 exchange offers a tax-efficient path to a more balanced portfolio.

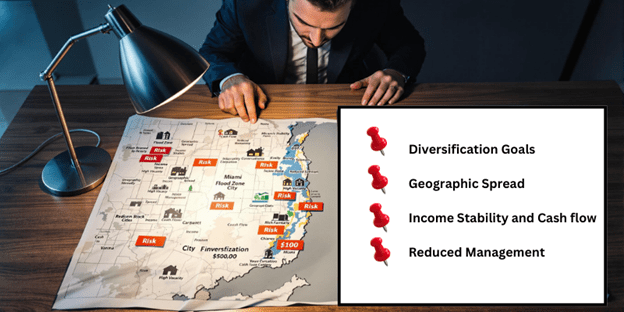

Why Diversification is Critical for Accredited Investors

Diversification is a bedrock principle of investing, and real estate is no exception. If your $2 million portfolio is tied to a single rental property in a coastal city, a natural disaster, zoning change, or tenant turnover could slash your returns. Accredited investors often juggle substantial holdings—sometimes millions across multiple properties—making risk management paramount. Over-concentration amplifies vulnerability: a retail center in a declining mall district, a multifamily unit in an oversaturated market, or a rural plot with no development prospects can drag down your wealth.

A 1031 exchange flips this script. Instead of cashing out and losing 20–30% of your gains to federal and state taxes (e.g., $300,000 on a $1 million gain), you reinvest the full amount. That extra capital—unshackled from the IRS—lets you diversify into new asset classes, markets, or management styles. It’s not just about avoiding risk; it’s about seizing opportunities to optimize your portfolio for the long haul.

The Mechanics of Diversification via a 1031 Exchange

The “like-kind” rule is your gateway to diversification. Unlike stocks or bonds, where diversification might mean buying unrelated sectors, real estate’s “like-kind” definition is broad yet purposeful. You’re not locked into replacing a house with a house—you can trade across categories as long as the intent is investment. Here’s how it works:

- Property Type Swaps: Sell a residential rental and buy a commercial office, industrial warehouse, or retail space, tapping into different economic drivers.

- Multiple Property Purchases: Offload a $3 million asset and acquire three $1 million properties—perhaps a mix of residential, commercial, and land—spreading exposure.

- Geographic Variety: Exchange a property in a stagnating market (e.g., a rust-belt rental) for assets in growth hubs like Austin, Nashville, or Charlotte.

- Passive Ownership via DSTs: Reinvest into a DST, owning a slice of a $50 million institutional-grade property managed by pros, diversifying into assets you couldn’t buy solo.

The tax deferral supercharges this process. Without it, a $2 million sale with a $500,000 gain might net you $1.85M after taxes (assuming a 30% combined rate). With a 1031 exchange, you wield the full $2 million, amplifying your ability to diversify strategically.

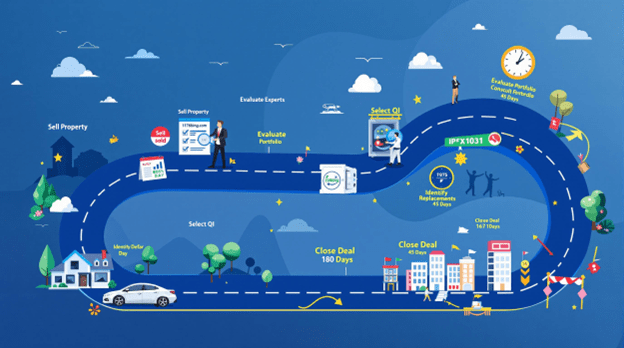

Step-by-Step: How to Diversify with a 1031 Exchange

Executing a 1031 exchange to diversify your real estate portfolio is a powerful move for accredited investors, but it demands precision and foresight to maximize its potential. This isn’t a casual transaction—it’s a deliberate strategy to transform a concentrated holding into a balanced, risk-mitigated collection of assets, all while deferring the capital gains taxes that could otherwise erode your wealth. The process hinges on strict IRS timelines and rules, requiring coordination between financial experts, Qualified Intermediaries (QIs), and cutting-edge platforms like the Great Point Capital’s Alternative Marketplace. Whether you’re aiming to spread your investments across geographic markets, shift from residential to commercial properties, or embrace passive income through Delaware Statutory Trusts (DSTs), this detailed roadmap guides you through each critical step. With the right approach, you can turn a single property sale into a diversified powerhouse—here’s how to make it happen.

Evaluate Your Portfolio

Begin by taking a hard look at your current real estate holdings to identify vulnerabilities and opportunities for improvement. Are you overexposed to one city, like Miami, where a hurricane or market saturation could jeopardize your returns? Perhaps your portfolio leans too heavily on single-family rentals, leaving you at the mercy of tenant turnover and maintenance costs. Define your diversification goals with clarity—do you want geographic spread to hedge against regional downturns, income stability from higher-yield assets, or reduced management burdens through passive investments? This step is foundational, as it shapes your exchange strategy. For instance, if your $2 million in Chicago rentals feels like a liability, you might target a mix of commercial and rural properties elsewhere. A thorough audit sets the stage for a purposeful pivot.

Consult Experts

Diversifying via a 1031 exchange isn’t a solo endeavor—bring in seasoned professionals to ensure you’re maximizing tax deferral and investment potential. Engage a tax advisor to calculate your capital gains exposure (e.g., a $1 million gain could mean $300,000 in taxes without deferral) and confirm eligibility under IRS rules. Pair this with a real estate expert who understands market trends and property types, helping you pinpoint assets that align with your diversification vision—say, shifting from residential to industrial. This collaboration sets a smart foundation, reducing guesswork and aligning your exchange with long-term financial goals. Their insights can also highlight hidden opportunities, like undervalued markets or sectors poised for growth, ensuring your reinvestment is both tax-efficient and strategic.

Select a Qualified Intermediary (QI)

A QI is non-negotiable in a 1031 exchange—they’re the gatekeeper who holds your sale proceeds, ensuring IRS compliance and keeping the process tax-deferred. Opt for a reputable firm like IPX1031’s team, known for its legal and financial expertise, especially when millions are on the line—security isn’t optional for accredited investors. Research their track record, bonding, and insurance; a QI mishandling funds could derail your diversification plan. They’ll guide you through paperwork and timelines, acting as a neutral third party between sale and purchase. This choice is your first line of defense against errors, so prioritize experience and reliability to safeguard your capital as you diversify.

Sell Your Property

With your QI in place, it’s time to market and sell your relinquished property—the asset you’re trading out of to fuel diversification. Work with a real estate agent to price it competitively (e.g., a $1.5M rental with a $500K gain), maximizing proceeds for reinvestment. Coordinate closely with your QI to transfer funds into escrow immediately after closing—any direct access to cash voids the deferral. Timing matters here; a slow sale could shrink your 180-day window, so list early and strategically. This step converts your existing holding into liquid potential, ready to diversify across new markets or asset classes without tax friction.

Leverage Great Point Capital

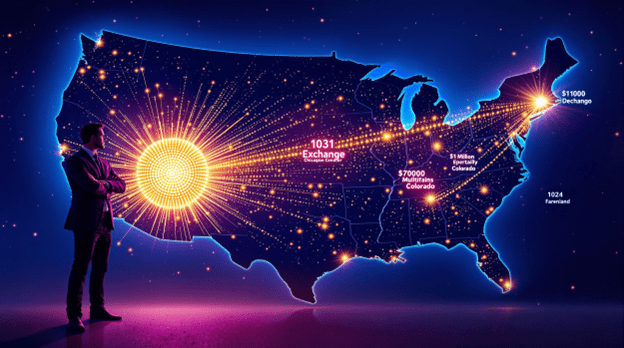

Navigating replacement options can feel overwhelming, but the Great Point Capital Alternative marketplace turns complexity into opportunity for accredited investors. This platform offers a suite of tools to explore traditional properties—think office buildings or farmland—or passive DSTs, connecting you directly to sponsors, QIs, and curated listings. Its interface cuts through the noise, letting you filter by location, type, or yield to match your diversification goals, like pairing a Texas retail center with a Colorado multifamily. You can also access market insights and track deadlines, ensuring you stay ahead of the 45-day identification crunch. With Great Point Capital, you’re not just finding properties—you’re building a diversified portfolio with precision and ease.

Identify Replacements (45 Days)

Within 45 days of your sale, you must formally identify replacement properties—a critical deadline that shapes your diversification outcome. List up to three options (or more under the 200% value rule, capping at twice your sold property’s price), aiming for variety—perhaps a retail center in Texas for steady leases, a multifamily in Colorado for growth, and a DST in California for passive income. Use the Great Point Capital Alternative marketplace to research and submit your list to your QI, ensuring compliance with IRS Form 8824 requirements. Be strategic: prioritize properties that balance risk and reward across sectors and regions. This step locks in your diversification vision, setting the stage for a tax-deferred transformation.

Close the Deal (180 Days)

Finalize your purchases within 180 days of the sale, ensuring the total value and debt of replacements match or exceed the relinquished property to defer all gains—fall short, and you’ll owe taxes on the difference. Coordinate with your QI to release escrow funds as you close on each property, whether it’s a $1M warehouse or a $2M DST stake. Work with lenders if replacing mortgage debt, and lean on Great Point Capital to streamline closings across multiple deals or markets. Double-check titles, leases, and due diligence—rushing risks costly oversights. When the dust settles, your QI confirms the exchange, and your diversified portfolio is complete, tax-deferred and poised for growth.

Real-World Examples: Diversification in Action

Let’s paint a picture with three scenarios tailored to accredited investors:

- Scenario 1: Urban Condo to Mixed Portfolio

You own a $1.5M condo rental in San Francisco—high maintenance, vacancy risks in a tech-heavy market. You sell, deferring a $500,000 gain, and use a 1031 exchange to buy a $900,000 suburban multifamily in Raleigh (steady tenants) and a $600,000 self-storage facility in Boise (recession-resistant). Result? Two income streams, two growth markets, zero taxes paid. - Scenario 2: Residential Overload to Commercial Shift

Your $2M portfolio of single-family rentals in Phoenix is a management nightmare—tenants, repairs, turnover. You exchange into a $2M medical office building in Atlanta, leased to a stable healthcare tenant. Outcome? One property, higher cash flow, and a sector less tied to housing cycles. - Scenario 3: Active to Passive Mastery

A $3M apartment building in Chicago eats your time. You sell and reinvest via Inland Private Capital into a DST owning a $60M Class-A office tower in Dallas. You now hold a 5% stake, defer $800,000 in gains, and enjoy monthly distributions without lifting a finger.

These examples showcase how a 1031 exchange turns a single asset into a diversified powerhouse, tax-deferred.

The DST Advantage: Diversification Without the Headaches

Delaware Statutory Trusts (DSTs) deserve a spotlight for accredited investors craving diversification with ease. Per Inland Private Capital, DSTs let you own fractional interests in “institutional-quality properties”—think $100M multifamily complexes, office towers, or logistics centers. A $1M investment might buy a 1% stake in a $100M asset, blending your portfolio with high-grade real estate typically reserved for pension funds or REITs.

Why DSTs shine:

- Scale: Access properties far beyond solo buying power.

- Management: Sponsors handle leases, maintenance, and strategy—perfect for busy investors.

- Income: Expect 4–6% annual returns, paid passively, per industry norms.

- Diversification: Pair a DST with other holdings for a mix of active and passive assets.

Using The Great Point Capital’s Alternative Marketplace, you can browse DST listings, connect with sponsors, and align them with your 1031 exchange—all in one platform. It’s diversification meets simplicity.

Advanced Strategies for Maximum Diversification

Beyond basic swaps, accredited investors can push the envelope to unlock the full potential of a 1031 exchange for diversification. These advanced tactics go beyond simply replacing one property with another—they leverage the tax-deferred structure to reimagine your portfolio’s scope, resilience, and profitability. Whether you’re consolidating fragmented holdings, timing market cycles, or optimizing debt, these strategies elevate diversification into a sophisticated wealth-building play. With tools like the Great Point Capital Alternative Marketplace offering real-time market data and seamless transaction support, you can execute these moves with precision, turning a single sale into a diversified empire tailored to your financial vision.

Consolidation to Expansion

Own five scattered rentals worth $500K each across a single city, bogged down by inconsistent cash flow and management headaches? Sell them via a 1031 exchange and reinvest the $2.5M into two $1.25M properties in different states—perhaps a multifamily building in North Carolina and a retail plaza in Oregon—then add a Delaware Statutory Trust (DST) for passive exposure to a $25M office tower. This approach streamlines your portfolio from five high-maintenance assets into three strategic holdings, balancing active and passive income while spreading geographic risk. For instance, consolidating urban rentals into a mix of suburban and rural assets can hedge against city-specific downturns, amplifying both diversification and efficiency. It’s a bold reset that preserves your capital and aligns with long-term growth.

Market Timing

Exit a peaking market—like a $2M condo in a speculative bubble, say Miami in mid-2025—and diversify into undervalued regions or recession-proof sectors such as self-storage in the Midwest or healthcare facilities in the Southeast. This tactic capitalizes on high sale prices before a correction, channeling proceeds into markets with untapped potential, like Boise or Raleigh, where growth is accelerating. By deferring taxes, you maintain the full $2M to split across multiple assets, perhaps a $1M industrial park and a $1M senior living center, each tied to different economic drivers. Timing matters—use Great Point Capital’s market trend insights to pinpoint entry points, ensuring your diversification aligns with macroeconomic shifts and positions you ahead of the curve.

Leverage Debt

If your sold property had a $1M mortgage on a $2M sale, replace it with equal or greater debt on replacement properties to defer all gains—then diversify across multiple debt-backed assets, like a $1.2M apartment complex and an $800K retail strip, both financed strategically. This preserves the tax deferral by matching or exceeding the original loan, while the additional leverage boosts your buying power to acquire a broader range of properties. For example, pairing a high-debt urban asset with a low-debt rural one balances risk and cash flow potential across your portfolio. Debt replacement isn’t just compliance—it’s a diversification multiplier, letting you stretch your equity into new sectors or regions without dipping into cash reserves. Consult your tax advisor to optimize this move, as precision here is key to avoiding taxable “boot.”

Benefits Beyond Diversification

A 1031 exchange isn’t a one-trick pony—additional perks amplify its value:

- Tax Deferral: Reinvest every dollar, not just what’s left after taxes.

- Cash Flow Boost: Upgrade to higher-yield properties while diversifying.

- Legacy Planning: Defer gains indefinitely; heirs inherit at a stepped-up basis, potentially tax-free.

Pitfalls to Sidestep

- Tight Deadlines: Miss the 45-day identification or 180-day closing, and taxes hit. Use 1776ing.com’s tracking tools to stay on schedule.

- Value Shortfalls: Replacement properties must match or exceed the sold property’s value and debt. Undervalue, and you’ll owe taxes on the difference (“boot”).

- Due Diligence: Diversifying into new markets or types demands research—rushing risks flops. Tap your QI or Great Point Capital for data-backed options.

Why 2025 is the Moment to Diversify

As of February 20, 2025, real estate dynamics are shifting. Coastal markets face oversupply, while Sunbelt cities boom. Interest rates fluctuate, and tax policy debates loom. A 1031 exchange lets you sell high, diversify smart, and defer taxes—positioning you for stability or growth. With Great Point Capital, reducing friction—connecting QIs, properties, and DSTs—you’ve got a clear path to act now.

Typical Investor Scenarios: From $1M to a $3M Diversified Portfolio

Consider Jane, an accredited investor with a $1M rental in Los Angeles (purchased for $400K). She sells in 2025, deferring a $600,000 gain. Using a 1031 exchange via the Great Point Capital Alternative marketplace, she:

- Buys a $700K retail center in Austin (tech-driven demand).

- Adds a $400K farmland plot in Iowa (inflation hedge).

- Invests $900K in a DST (multifamily in Denver, passive income).

Her $1M grows to $2M in assets, diversified across three types and regions, with zero taxes paid. Over a decade, appreciation and income could push her portfolio past $3M—all tax-deferred.

Conclusion: Diversify Smarter with a 1031 Exchange

A 1031 exchange transforms a single property into a diversified portfolio, shielding you from risk while unlocking growth—all without the tax bite. For accredited investors, it’s a strategic lever to balance residential, commercial, and passive holdings across markets. With the Great Point Capital Alternative marketplace simplifying the process—from sourcing to closing—you can diversify with confidence. Don’t let concentration cap your potential—start your next exchange today.

FAQs: Diversifying with a 1031 Exchange

Yes! You can sell one property and buy several replacements, as long as their total value equals or exceeds the sold property’s price and debt. For example, sell a $2M asset and buy three $700K properties—diversification achieved. Use Great Point Capital to find options fast.

No problem—start with familiar assets or lean on DSTs. A 1031 exchange into a professionally managed DST (e.g., a $50M office building) diversifies you into commercial without the learning curve. Research via your QI or Great Point Capital ensures informed choices.

Spreading investments across property types (e.g., retail, residential) and regions (e.g., Texas, Colorado) means a downturn in one doesn’t tank your whole portfolio. A 1031 exchange makes this tax-efficient, preserving capital for broader exposure.

Nope—there’s no cap. Exchange a $1M property into a $2M portfolio, then later into $4M, diversifying each time, all tax-deferred. It’s a compounding strategy for accredited investors building empires.

The Great Point Capital Alternative marketplace connects you to property listings in one platform, cutting through complexity. It tracks deadlines, offers market insights, and aligns options with your goals—making diversification smoother and smarter.

Disclosures:

The content published on the 1776ing Blog is for informational and educational purposes only and should not be considered financial, legal, tax, or investment advice. The insights shared are intended to promote discussions within the alternative investment community and do not constitute an offer, solicitation, or recommendation to buy or sell any securities or investment products.